Participant Summary Overview:

Contribution types

You may make Pretax, Roth and After-tax contributions to your plan. You may contribute up to $20,500, plus and an extra $6,500 if you're 50 or older, Pretax and/or Roth. Your account may not receive more than $61,000, plus an extra $6,500 if you’re over age 50, total/max (including pretax, Roth, after-tax and employer contributions) for 2022. Participant contributions are always 100% vested.

Profit Sharing

This is an optional amount of profit sharing that your employer may make if the business is profitable and the company decides to make additional contributions to your account. The amount you receive is based off of your years of service, salary, age, and job classification. This contribution source is not guaranteed every year and is made at the discretion of management. The money also vests 20%/year of service.

Employer Match

Your employer also matches the next 10% of your contributions at 0.25%. Effectively, if you put in 15% then you get the 4% Safe Harbor Match plus an additional 2.5%. You are leaving additional compensation “on the table” if you are contributing less than 15%. This money vests 20%/year of service so that after 5 years you are 100% vested.

Participant Loans

Participant loans are not authorized under your plan and there are no exceptions to this rule.

Safe Harbor Contribution

Your employer matches your 1st 3% dollar for dollar and your next 2% at 50%. Effectively, if you put in 5%, you get a 4% match. This money is always 100% vested.

Participant Hardship Withdrawals

Participant hardship withdrawals are not authorized under your plan and there are no exceptions to this rule.

Rollover and Transfers

Rollovers and transfers into the plan are allowed at any time. Rollovers and transfers out of the plan are only allowed after you reach the age of 59.5 or are separated from employment.

Withdrawals

Withdrawals are only permitted after you have separated from service or attained the age of 59.5.

Plan documents and supporting resources:

Plan Document

The plan document is the long version of all the details about your plan, how it works and the rules everyone must follow: View your plan document.

Summary Plan Description (SPD)

This is the very abbreviated version of your plan document. It does not contain all features and details of your plan but it has most of the most of the plan features that plan participants request most: View your SPD.

Current Fund Line-up

This is a current list of your investment options within the plan: View your fund line-up.

Sample Model Portfolio Allocation

This is an example of the allocations of the funds we build for you inside of your model portfolio: View model portfolios.

Safe Harbor

Notice

This document outlines your eligibility to receive required contributions from your employer to make your plan a Safe Harbor plan, which lowers the reporting requirements of your plan because they provide this contribution: View your Safe Harbor Notice.

404(a)(5) Participant Fee Disclosure

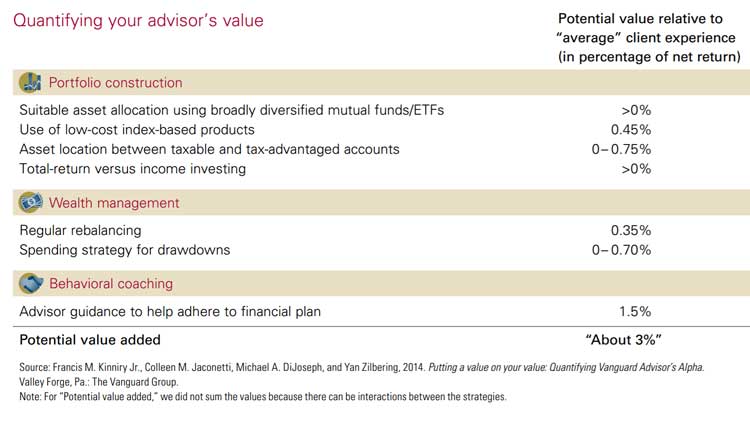

This report discloses all fee within the plan that it is transparent and you understand who is receiving what compensation for which services: View your 404(a)(5) Participant Fee Disclosure.

Here is a practical example to help you understand what you pay:

rebel Financial is a Registered Investment Advisor that provides retirement planning, estate planning, financial planning, and investment management services to individual and institutional clients. To get a more detailed description of the company, its management, and practices, view our (form ADV, Part2A) and Disclosures.

Fiduciary & Fee-Only Financial Advisors and Planners